Webinars

On-Demand Webinars

Unlock the secret weapon that top lenders and borrowers are using to outsmart today’s volatile interest rate environment: master fixed-rate pricing with swaps and gain an unfair advantage in the lending marketplace.

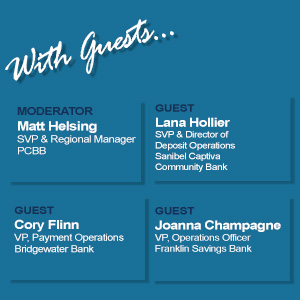

Hosted by PCBB and Fiserv, industry peers from a panel of community financial institutions will share their firsthand experiences clearing Canadian checks with PCBB and the Fiserv Clearing Network. Gain insights from both an operational and financial perspective as our guests discuss faster settlement times and the elimination of shipping costs — all without the additional investment in new equipment.

In this virtual roundtable with a panel of community financial institution executives, we explored their journey of implementing CECL. Here are the strategies, lessons learned and insights that they can share with their peers based on their implementation journey.

Virtual roundtable led by PCBB's profitability expert, Janet Leung, to discuss proven and peer-tested strategies to improve profitability. The event showcased a panel of community financial institution executives that have championed customer profitability.

In this webinar, we look at the benefits of generating upfront fee income through hedging and discuss how most loans, including those already on your books qualify.

A new accounting standard means lots of changes, including how qualitative factors (Q Factors) apply. In this webinar, gain an understanding of Q Factors with CECL, and learn how they need to be applied under CECL compared to the incurred loss model.

As your customers expand their businesses across borders, they need to know that your financial institution can provide international services like foreign wires or check clearing. You easily can with PCBB as a partner. Join us for a complimentary 30-minute webinar where we will discuss the benefits of using international services.

Join PCBB as we work through live examples of different methods and evaluate the pros and cons.

Are you currently providing international services for your customers? The global market is growing and with small businesses making up 97% of all exporters, your customers will be growing too. Knowing how to support your business customers will deepen long-term customer relationships with an enhanced suite of services.

We will cover how FX Forward Contracts work, the benefits to your customers and to your bank. When dealing with small margins as a small international business, the fluctuations of international currencies can make it hard to plan for success. Join PCBB to discuss locking in foreign exchange rates for settlement at a future date.