Items include

- 2 Whitepapers

- 1 Case Studies

- 1 Podcasts

- 4 Webinars

- 38 BID Newsletters

international

Whitepapers

Cross-border payments are changing and business owners expect to transfer money quickly. Swift GPI allows community financial institutions to meet their customers’ needs and generate additional fee income for their institution.

Recognizing the increasing importance of global transactions, this paper provides six strategies and actionable takeaways to help nurture the international growth of your small business customers.

Case Studies

How one community bank strengthened its international wire offering, improved efficiency, and delivered a better client experience with PCBB.

Podcasts

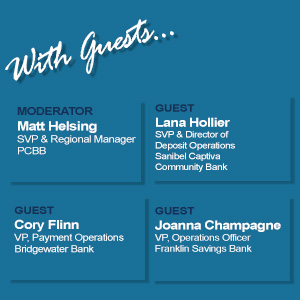

In this episode of Banking Out Loud, PCBB’s Matt Helsing talks with three community bankers about modernizing the way they clear Canadian checks. By leveraging PCBB’s Canadian Check Image solution through the Fiserv Clearing Network, they’ve streamlined operations while reducing costs associated with overnight shipments and exchange rates.

Webinars

As your customers expand their businesses across borders, they need to know that your financial institution can provide international services like foreign wires or check clearing. You easily can with PCBB as a partner. Join us for a complimentary 30-minute webinar where we will discuss the benefits of using international services.

We will cover how FX Forward Contracts work, the benefits to your customers and to your bank. When dealing with small margins as a small international business, the fluctuations of international currencies can make it hard to plan for success. Join PCBB to discuss locking in foreign exchange rates for settlement at a future date.

Are you currently providing international services for your customers? The global market is growing and with small businesses making up 97% of all exporters, your customers will be growing too. Knowing how to support your business customers will deepen long-term customer relationships with an enhanced suite of services.

Hosted by PCBB and Fiserv, industry peers from a panel of community financial institutions will share their firsthand experiences clearing Canadian checks with PCBB and the Fiserv Clearing Network. Gain insights from both an operational and financial perspective as our guests discuss faster settlement times and the elimination of shipping costs — all without the additional investment in new equipment.

As online commerce continues expanding for small businesses, so does the revenue potential for CFIs that process foreign transactions. We provide strategies to educate your SMB customers about going international.

The volatility of the foreign exchange rate market can be challenging on your small business customers that do business internationally. We explore FX forward contracts as an option you can offer to provide more certainty in this area, thereby increasing customer loyalty.

Small businesses are increasingly doing business across international borders, and in need of international banking support. We discuss how CFIs can best serve their customers’ cross-border banking needs and stay ahead of the competition.

The pandemic caused many smaller companies to adopt digital technologies that expanded their ability to reach customers across the US and in other nations. Many of the companies say that cross-border commerce is a way to grow businesses and keep up with the competition. As a result, CFIs with international payment solutions may have opportunities to strengthen relationships, add new customers, and grow fee income.

The US dollar is at parity with the euro for the first time in 20Ys, and up against numerous other foreign currencies. That’s not necessarily a good thing for companies that do business overseas. American goods are more expensive, and the dollar’s strength deflates the value of funds earned overseas. We discuss ways you can support your commercial customers who have international business ventures.

According to the FDIC, there are approximately 7MM US households that remain unbanked and over 50MM that are underbanked. These groups have received more attention from regulators lately. While we know you are reaching out to them in your communities, we give you five strategies to help engage these potential customers.

Some community financial institutions may not think that cross-border remittances are in demand in their communities. Yet, in its November report, the World Bank projected growth of 7.3% of remittance payment volume in 2021. Could some of this spill over into your footprint? Here are three ways to successfully provide remittance services.

Looking for international business customers? You don’t need to look far. Many reside in your communities, but in places that you may not consider. According to JPMorgan Chase, 14% of SMBs plan on expanding beyond US borders in the next 3Ys. We uncover three places to find SMBs needing international services.

The pandemic threw a major curveball at everyone, especially small businesses. Many changed gears and moved to an e-commerce model, which helped them survive. With fewer geographic barriers, global payments soared and the value of global digital payments is expected to increase 22% YoY in 2021. Here are three ways that community financial institutions can help their customers continue to thrive with global payments.

Small businesses are busy overseas. They are looking for more opportunities to not only grow, but sometimes survive. Last year’s e-commerce boom made international business even easier for many businesses. Small business international wire transfers increased to 17% last year from 10% in 2019. Is your institution supporting its customers with international payment solutions? If not, the competition will.

The cross-border payments market is valued at $21T and is growing at a 90% compound annual growth rate. This is one big reason to consider providing cross-border payments to your business customers. We have four more: small and medium businesses are engaging in more foreign trade, they trust their banks for help, you generate more fee income, and you can strengthen your relationship with your customers.

The WTO forecasts trade volumes will increase by 7.2% in 2021, bringing back robust global commerce. With that, community financial institutions will want to support their international business customers and trade finance is one way to do that. Not only does this help your customer, but your institution benefits as well with good returns, resilient assets, low defaults, and more.

As your small business customers expand to Canada, Mexico, and beyond, you will want to grow with them. If you provide international payment services, you can support them and gain valuable fee income. We map out what these customers are looking for in international payment solutions.

While the coronavirus had thrown import and export business for a loop, trade is starting to normalize. So, it is a good time to think of how to serve international business customers.

After the global slowdown ends, international business will expand again. We offer you steps to guide your international customers when this happens.

Many community financial institutions haven't seen the growth in small businesses that they'd like. We have some tips.

The EXIM lets community banks write bigger lines of credit with less risk and stronger profits. What your institution should know.

With more SMBs buying and selling overseas as well as traveling internationally, there is a growing demand for foreign bank notes and other international services. Can you meet this demand?

McKinsey reports that more people and entities will regularly use international payments in the next 5Ys. Is your institution ready for this?

Many community banks are looking to increase their back office efficiency and provide faster availability of funds, with checks between the US and Canada. We explain how this can be done.

Small businesses are at the forefront of international trade. We provide tips to ensure they come to you for international services.

Small businesses are increasingly selling local, but thinking global. Community banks can increase and build deeper relationships by helping these business customers go international.

Export finance might seem risky to some bankers, yet it can benefit your bank and your international business customers. We walk you through it.

While many small and mid-sized business customers focus within their geographic region, an increasing number are extending well beyond that and selling to customers overseas. We provide you with some ways to help them do this.

An OFX study found that 58% of small businesses had international customers. Canada provides small business customers with an opportunity to grow their businesses internationally. How your bank can help.

Could asking more questions help bankers get more business? What one recent case study shows.

Despite rapid growth in cross-border payments, there are still challenges in areas such as currency conversion, fees, security, and settlement delays. We detail possible solutions.

Purchasing or selling goods internationally can be risky when it comes to currency exchange rates. We explain how FX forward contracts can help SMB customers better manage international cash flow.

There are clear benefits to CFIs adopting FX forward contracts to serve clients with international exposure, while managing their own FX risk. However, many CFIs are cautious about entering this space. We explore some of the strategies that can help them overcome key challenges.

Swift has been implementing significant changes that are designed to enhance the speed, transparency, and reliability of cross-border payments. These include Swift GPI, ISO 20022, and Swift Go. By embracing these changes, CFIs can enhance their international offerings in a rapidly shifting financial landscape.

The need for speed has become a central goal for cross-border payments. Smaller businesses stand to benefit from improvements. We discuss how cross-border payments can be used to encourage customer loyalty.

Supply chain financing had already gained speed prior to the pandemic, but activity has picked up substantially over the past two years. What CFIs should know about the rise in supply chain financing and why they may want to consider adding it into the fold.

The European Payments Initiative is moving forward and is poised to change the global banking landscape if it is successful. We discuss what those changes look like and how they could affect US financial institutions.

Your international business customers need to manage risk, both interest rate risk and foreign exchange risk. Educating them on hedging and how it can mitigate these risks will not only help your customers, but solidify your customer relationships and allow you to grow income. We walk you through a potential scenario with a customer as they invest in equipment built overseas and how hedging can provide predictability and mitigate risk.

Wire processing automation was spurred on by the pandemic. Yet, there are several reasons to consider it for the long-term, including faster processing, more money saved and earned, and fewer errors. We provide you with all the information you need to get started.

If you provide international wires for consumers, you will want to know about the latest regulation modification. We give you the specifics.

Although some central banks are researching and testing distributed ledger technology (DLT), there is still a lot of work to be done. We give you an update.

Millions of international wire transfers go through the financial web each day. But, wire fraud can and does happen. What one bank's lesson can teach your bank.