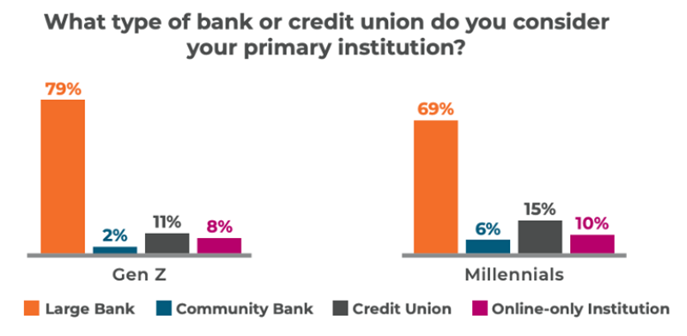

In 2011, when Tencent added mobile payments to its messaging app, WeChat, few predicted it would become the default operating system for millions of small businesses in China. Suddenly, a corner coffee shop could not only accept payments but also manage suppliers, market to customers, and access working capital — all without leaving a single app. In other words, what began as a chat app evolved into an indispensable business ecosystem. Today, that same transformation is starting to take hold in the US, with tech giants and non-bank platforms embedding financial tools into broader business services, creating super apps that bundle banking with operations. For community financial institutions (CFIs), this represents both a threat and an opportunity: lose a generation of digital-first entrepreneurs — or win them over by offering the trust, guidance, and personalization that big platforms cannot.The Rise of “Super” Business AppsMeta recently announced that US customers can now make payments directly through its WhatsApp Business app, moving the market closer to the super app model that combines messaging, shopping, and payments in a single experience. In other regions, platforms like WeChat and Grab have already blurred these lines, serving not only as payment and shopping tools but also as small business hubs with supplier management, payroll, and marketing features.Other examples, like Apple’s Business Essentials, integrate device management with credit and savings, while Google is piloting embedded lending and cash flow management for small and medium-sized businesses (SMBs). E-commerce platforms like Shopify and Amazon already provide in-app credit, inventory tools, and customer acquisition services, too.The message here is clear: SMBs want a one-stop shop where they can manage everything. Zooming into finance specifically, embedded finance is no longer just a consumer-facing play — it is reshaping how entrepreneurs handle banking. For CFIs, however, the rise of super apps presents real risks. The Embedded Finance ShiftBy 2030, embedded finance is projected to reach $7.2T globally. At the same time, $84.4T in assets will pass from baby boomers to younger generations, with more than 70% of boomer-owned SMBs expected to change hands over the next 20 years. This massive wealth transfer, paired with a generational shift in business ownership, highlights how central embedded finance is becoming.Gen Z and Millennial entrepreneurs are digital natives with very different expectations than their boomer or Gen X predecessors. According to Visa, 41% of next-gen SMB decision makers already use 6–9 banking innovations, and they rely heavily on platforms like TikTok, Instagram, and YouTube for financial guidance. Meanwhile, Financial Brand reports that 79% of Gen Z and 69% of Millennials already use large banks as their primary institution. Their reasons are straightforward:

- Digital sophistication, with Amazon- or Instagram-level personalization expected across devices.

- Mobile-first access, with nearly half rarely or never visiting a branch.

- Payment flexibility, given that 72% are frequent users of P2P tools like Venmo and Zelle.

- Cybersecurity, with over 80% wanting more robust fraud protection.

Source: Apiture

Given that nearly half of SMBs fail within five years (and two-thirds within ten), the appeal of a one-stop business banking platform becomes clear. Solutions like Square and Shopify already bundle payments, credit, and analytics into seamless experiences. CFIs that cannot match this convenience risk losing relevance unless they can bring something even more valuable. This reality may feel daunting, but it also clarifies where CFIs can stand apart.

How CFIs Can Compete in a Super App WorldDespite the risks, CFIs hold a key advantage: trust and relationships. Surveys show that while younger SMBs adopt fintech tools quickly, they still value personal advisory support, especially when it comes to analytics and decision-making.Nearly half also report low confidence in interpreting financial data — a gap that CFIs are uniquely positioned to fill. Trust remains an edge, but only if paired with seamless digital experiences that can meet entrepreneurs where they are. To turn these strengths into staying power, CFIs will need to be intentional about how they compete in a super app world.Here are five strategies for CFIs to seize an advantage over super apps:

- Monitor embedded business finance partnerships. Track key sector players like Shopify Capital, PayPal Working Capital, and Amazon Lending. Their rapid growth signals how SMB expectations are shifting toward instant, data-driven financing.

- Differentiate with relationship-based advisory. Younger SMB owners need guidance, but aren’t finding it on apps. CFIs can win loyalty by offering consulting on analytics, financial wellness, and cash flow planning, bridging the gap between data and decision-making.

- Explore more embedded partnerships. Partner with accounting, e-commerce, or supply-chain apps to integrate services while maintaining brand control and oversight. The most successful CFIs will identify where they can embed themselves into their customers’ ecosystems, creating recipes for growth rather than resisting change.

- Create seamless business banking ecosystems. Half of SMBs fail within five years, due in part to the highly fragmented nature of their systems. CFIs can stand out by providing unified platforms that combine payments, lending, and cash flow management.

- Target next-gen entrepreneurs with social proof. This generation relies heavily on peer ratings and reviews. CFIs can adapt marketing and service delivery to emphasize authenticity, community ties, and mobile-first features that resonate with digital natives.

As PCBB’s CEO, Curt Hecker, noted in a recent podcast, “Community banks are increasingly adopting embedded finance programs and integrating banking services into third-party platforms. And this is something that PCBB is doing as well. And this is really viewed as essential for capturing new markets and revenue streams overall.” For the strategic planning cycle ahead, Hecker emphasizes that digital transformation and modernization are at the forefront, with the success of CFIs now “increasingly depend[ing] upon the digital engagement, wallet share, and the relationship depth rather than just the traditional market share.”How CFIs Can Rise to the OccasionIn many ways, today’s banking sector mirrors the early days of WeChat. What started as a messaging app became an all-encompassing platform because it solved the daily pain points of small businesses. The same could happen in the US as more super apps move deeper into financial services.CFIs won’t win by out-scaling Big Tech — but they can win by out-serving it. Those that combine digital tools with personal advice and community roots can capture the next generation of business owners. However, the window is narrow; once entrepreneurs are locked into super app ecosystems, switching costs rise. If CFIs pay attention to trends and start adapting now, and quickly, they can capture the next generation of business owners before it’s too late.