Industry Insights

Welcome to our Industry Insights Hub

Staying on top of industry trends is not just a benefit—it’s a necessity. Our comprehensive suite of meticulously curated resources - white papers, podcasts, webinars, articles, and case studies, are to empower community financial institutions with deep, actionable insights.

With our commitment to delivering industry-leading resources, community financial institutions can sharpen their competitive edge and make strategic, well-informed business decisions. Step into our hub where expertise meets innovation, driving your institution’s success forward.

Case Studies See All

Podcast (Banking Out Loud) See All

Modernizing Canadian Check Clearing: Community Bank Insights

Hear how three community banks modernized their Canadian check clearing process with PCBB’s Canadian Check Image solution through the Fiserv Clearing Network, helping them streamline operations, cut costs, and improve efficiency.

2026 Banking Predictions: A Discussion with PCBB’s President

PCBB President Mike Dohren shares 2026 predictions for community banks, from profitability and customer engagement to AI, cyber risk, stablecoin, and faster payments, with practical advice on data strategy, culture, and focused digital transformation.

White Papers See All

Webinars See All

Mastering Fixed Rate Pricing: Hedging Strategies & Opportunities

Master fixed-rate loan pricing with PCBB’s on-demand webinar. Discover how swaps mitigate interest rate volatility, boost lender profitability, and provide flexible financing solutions with real-world case studies and expert insights.

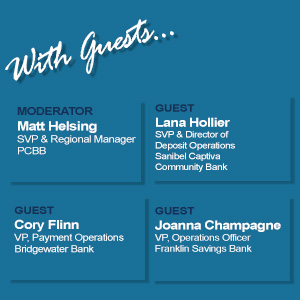

Insights from Banking Peers: Canadian Check Clearing Made Easy

Discover the benefits of clearing Canadian checks with PCBB and the Fiserv Clearing Network. Hear from industry peers as they discuss firsthand experiences.

Distilling the Secrets of CECL Success

A discussion with community financial institution experts Kimberly Anderson, Renee Byers, and Andy Shook on CECL strategies, tips, and implementation.

Hot Topics

From articles to White Papers, see a comprehensive collection of all of our resources on the topics your peers are talking about today.

Industry Indicators

Keep up on the economic indicators that are impacting the industry and the latest bank mergers and acquisitions in the works.