Current Expected Credit Loss (CECL)

Estimate Allowance for Credit Losses with CECL FIT®

CECL can be challenging, so let PCBB help you comply with the CECL accounting standard, while also receiving guidance from our advisors to understand your loan portfolio risk.

CECL FIT provides your team with two sources of insights:

- A robust, web-based solution that caters to your specific needs, mitigates risk and provides transparent reporting.

- Expert advisors who will assist you at every step of the way, including preparing for audits and exams.

Key Benefits:

- Easily run various Q Factors and what-if scenarios

- Assess the impact of credit loss for loans, unfunded balances, and HTM securities

- Build defensible documentation

- Get “exam-ready” with help from our advisors and resources

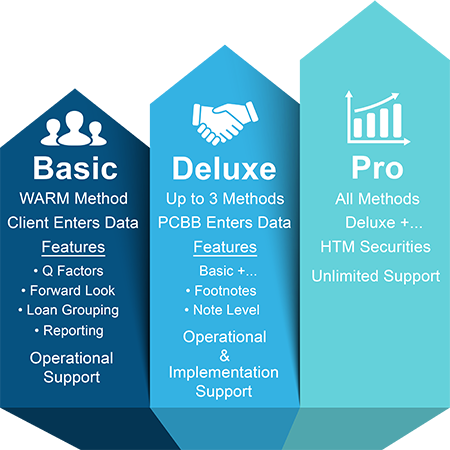

3 Tier Options to Meet Your CECL Needs: Today and Tomorrow

Institutions with less credit deterioration or loss experience can get started quickly and see which tier works best for each unique loan or securities segment.

With 3 tiers of CECL FIT, you will find a level that fits your unique institution. Our Right FIT Promise allows you to switch levels in the future, as your needs change.

CECL Client Testimonial

PCBB have been more than accommodating to assist us with our third-party validation. They helped explain the methodology to our validation firm, saving us hours and hours of time on our end.

Why Switch from In-house to Outsourcing CECL?

Michael Kerr, CCO of First Federal Bank, was initially determined to handle CECL compliance in-house. As his team got further in the process, he decided it was best to outsource instead.

“We were going to do CECL in-house, using SCALE, but we had concerns about the approach for our bank. We turned to PCBB’s Advisory Services team, who have the ability, expertise, and access to the data needed to support and defend our qualitative factors and methodologies.

I just reported to our board last month that we are now fully implemented with CECL, thanks to PCBB’s help.”

The Value Our Advisors Deliver

Our advisors can guide and assist you while you remain in complete control.

Here are some of the perks our advisory team offers:

| Knowledgeable team with decades of banking, accounting, and risk management experience | |

| Personalized education, training, and assistance with your Board | |

| Available from initial setup to quality control, model configuration, reporting, and beyond |