Results include

- 3 Videos

- 1 People

- 7 Webpages

- 1 Whitepapers

- 2 Case Studies

- 2 Webinars

- 4 BID Newsletters

Videos

People

SVP & Managing Director, Hedging Solutions

Femi Audifferen has over 23 years of banking and capital markets experience. At PCBB, Femi is currently Senior Vice President and Manager of Hedging Solutions. In that role, he helps clients strategiz...

Webpages

Feb 10, 2026

Master fixed-rate loan pricing with PCBB’s on-demand webinar. Discover how swaps mitigate interest rate volatility, boost lender profitability, and provide flexible financing solutions with real-world case studies and expert insights.

Feb 10, 2026

BLP protects community financial institutions from the risk of rising rates, with an interest rate hedge without any derivative implication.

Feb 8, 2026

Understand loan hedging and how you can generate fee income. Hear from Five Star Bank, SVP Commercial Banking Officer on how his bank has benefited.

Feb 2, 2026

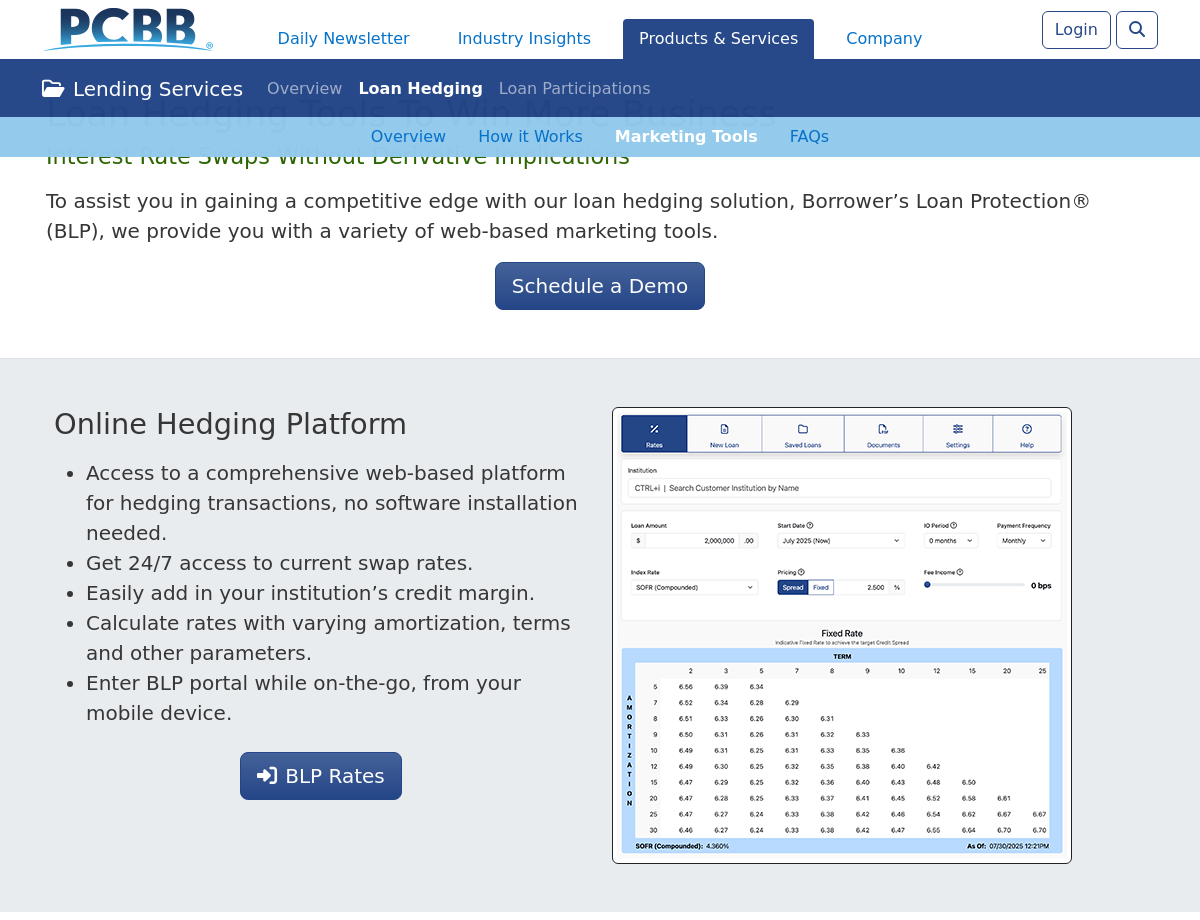

We offer loan hedging tools that lenders can use to gain a competitive edge and meet your borrowers’ hedging needs.

Feb 2, 2026

Provide long-term, fixed-rates to your customers, while your institution receives a floating rate through our loan hedging solution, Borrowers Loan Protection (BLP).

Feb 10, 2026

On-demand webinars covering a range of banking industry topics such as international payment, CECL, loan hedging, C&I, and customer profitability.

Feb 10, 2026

We help community financial institutions maximize revenue, increase efficiency, and manage risk through a robust suite of competitive banking services such as Cash Management, Lending Solutions, Loan Hedging, International Banking, and Advisory Services (

Whitepapers

Oct 24, 2023

When borrowers seek the stability of a fixed-rate loan and your institution prefers a floating rate loan it creates a disconnect between the needs of your borrower and your CFI. So, what can you do to fix it? Develop a loan hedging strategy. We offer insights on how to select the right hedging program and develop your hedging strategy, and look at how hedging can help reduce volatility.

Case Studies

May 30, 2025

Prism Bank expanded into aircraft lending by partnering with PCBB and BLP, gaining a flexible, relationship-focused hedging team. This collaboration enabled Prism to confidently enter a new market and better serve its clients.

Jul 1, 2018

How PCBB helped a rural community bank compete with the big banks and win by helping them offer their customers long term fixed rates while getting a floating-rate asset on the books.

Webinars

Jul 31, 2025

Unlock the secret weapon that top lenders and borrowers are using to outsmart today’s volatile interest rate environment: master fixed-rate pricing with swaps and gain an unfair advantage in the lending marketplace.

Feb 13, 2020

In this webinar, we look at the benefits of generating upfront fee income through hedging and discuss how most loans, including those already on your books qualify.

Dec 4, 2025

As community financial institutions continue looking for new sources of fee income, hedging may be the answer —particularly in an economic environment with mixed expectations.

Apr 15, 2025

With unpredictable interest rates and a changing financial market, loan-level hedging can help your CFI’s portfolio. We discuss how hedging benefits your portfolio and steps for finding the right hedging partner.

Feb 20, 2024

Economic indicators suggest that the Fed is likely to ease monetary policy by lowering the Federal Funds Rate at some point this year. We discuss what factors could influence the Fed’s decisions and how hedging strategies could benefit your CFI in this changing market.

Oct 10, 2024

Hedging can alleviate interest rate risk, but many financial institutions have qualms about using it. We explain common concerns bankers may have and discuss the benefits of dipping a toe in anyway.