Items include

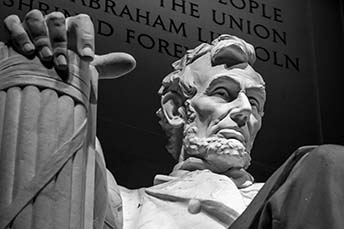

capital

A newly introduced bill aims to reduce regulatory burden and improve funding flexibility for community banks. We break down the key provisions and what they could mean for supervision, capital, and growth.

Some CFIs are generating capital by selling branches and leasing them back from the buyers. What pluses and minuses does this strategy involve, and how should CFIs that are interested proceed?

Higher interest rates and the cost burden they impose are driving a cycle of deleveraging and cash conservation at many companies. Small business owners are balancing the need to offset higher interest expenses and lessened credit availability while also addressing competing demands for strategic growth. We provide tips for how CFIs can help their business customers align their capital with their strategic plans.

Small businesses are struggling to access capital, despite strong demand. The SBA just launched the Working Capital Pilot Program, in the hopes of bridging the gap.

Some CFIs are finding that rising interest rates are causing their current calculated asset levels to show up as negative under the tangible capital rule used by Federal Home Loan Bank. Financial organizations across the country are asking for relief.

U.S. Treasury Secretary Scott Bessent calls for regulatory reforms tailored to CFIs, opening the door for simplified capital requirements and more lending capacity.

The EGRRCPA has redefined what counts as a small bank holding company. It raises the asset threshold from $1B to $3B. Is this something to consider?

In releasing the final rule, the federal regulators said 85% of community banks should be able to qualify for the new CBLR ratio rules. Does this include your bank?

Community banks can raise capital by utilizing Regulation A, which exempts companies from having to register public offerings with the SEC under certain circumstances. Could this work for your institution?

The Federal Reserve just concluded its annual capital adequacy annual stress test with 33 participating banks. While regulators don’t require CFIs to run stress tests to assess their capital adequacy, the federal banking supervisory agencies indicate that they should have the capacity to analyze the potential impact of adverse outcomes, and particularly encourage this for CFIs with CRE portfolios. We provide four steps to help form the foundation of an effective capital planning process.

Do you know how to deal with an unsolicited offer? We provide tips to help.

With rising rates for CDs, and a competitive deposit market, should your CFI pursue brokered deposits? We weigh the advantages of brokered deposits against their risks.

The federal government is investing more than $8.28B in community development financial institutions and minority depository institutions through the Emergency Capital Investment Program. See how your CDFI or MDI can benefit before the application deadline Jan. 31.

Big Data may help you with your capital development operations. We provide you with a few ideas.

Private equity firms are loaded up with investment capital in search of deals. Could this be an opportunity for your institution?

The Fed has cut rates more for EBA than the fed funds target rate. This is a good time to get a higher return.