Borrower’s Loan Protection®

Loan Hedging Solution — Not Your Typical Interest Rate Swap

Loan hedging can give your institution a competitive advantage. With Borrower’s Loan Protection (BLP), you can protect your institution from interest rate risk and win new business without derivative accounting or complicated, lengthy documents.

Meet your customers’ needs with the long-term, fixed-rate payment structure they want, while your institution receives a floating rate over the full term of the loan.

Key Benefits:

- Reduce rate risk and credit risk

- No requirement for hedge accounting, capital or collateral by your institution

- Generate fee income

- No swap implications

- Retain and acquire customers

Close More Loans with BLP®

Most loan hedging solutions offer 10-year terms. However, PCBB can provide terms up to 25 years. Our extended term-length options will help you stay competitive and mitigate debt service coverage so you can offer attractive, longer-term loans to your customers.

What Sets Our Loan Hedging Solution Apart

- Lenders never post collateral, especially in a falling rate environment when liquidity and capital are most important.

- BLP does not encumber the lender’s capital or ability to take FHLB Advances.

- Lender’s total exposure to the borrower is the same for BLP as any other swap-based hedge and in some cases less.

Why Choose PCBB as Your Lending Partner

This competitive hedging tool allows us to not only retain our key customers, but also attract new customers; since we can offer more attractive, flexible terms that many borrowers really want.

Loan Types That Work for BLP Hedging

We work with lenders and their borrowers on a wide variety of loan categories, providing financing for a plethora of loans, from medivac helicopters to tugboats to stainless steel beer vats. Listed below are a few of the more common loan types used with BLP.

Commercial Real Estate (CRE)

| Multi-family | |

| Owner-occupied | |

| Agriculture | |

| Manufactured housing | |

| Hospitality | |

| Self storage |

| Office, industrial and retail | |

| 501c3 nonprofit organizations | |

| Tax exempt transactions | |

| SBA 7a, 504 and USDA lending | |

| Construction & industrial-related deals |

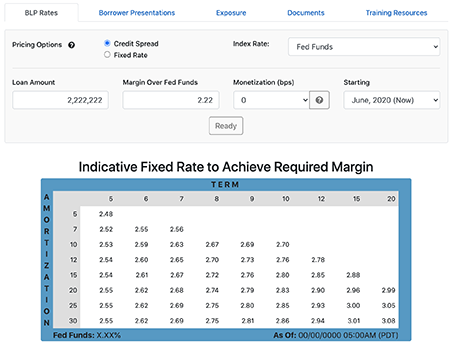

BLP Tools at Your Fingertips

As a BLP customer, you have access to marketing and loan pricing tools at no cost via our mobile-optimized BLP Portal. We provide you with resources and direct access to our team to support you in achieving your lending goals.

Discover what marketing tools we offer in our BLP Portal.