Results include

- 1 People

- 7 Webpages

- 1 Whitepapers

- 11 BID Newsletters

People

SVP & Chief Credit Officer

Cindy Cheng has over 20 years of experience in finance, with a concentration in credit risk management and commercial lending. Cindy is responsible for PCBB’s lending strategy and overall risk managem...

Webpages

Mar 5, 2026

Provide long-term, fixed-rates to your customers, while your institution receives a floating rate through our loan hedging solution, Borrowers Loan Protection (BLP).

Mar 5, 2026

Correspondent banking services for financial institutions such as cash management, risk management advisory services, international banking, and lending services.

Mar 4, 2026

Stress test your loan portfolio and evaluate the resulting impact on both earnings and capital.

Mar 3, 2026

BLP protects community financial institutions from the risk of rising rates, with an interest rate hedge without any derivative implication.

Mar 3, 2026

Learn the frequently asked questions about Borrower's Loan Protection and how BLP works.

Mar 2, 2026

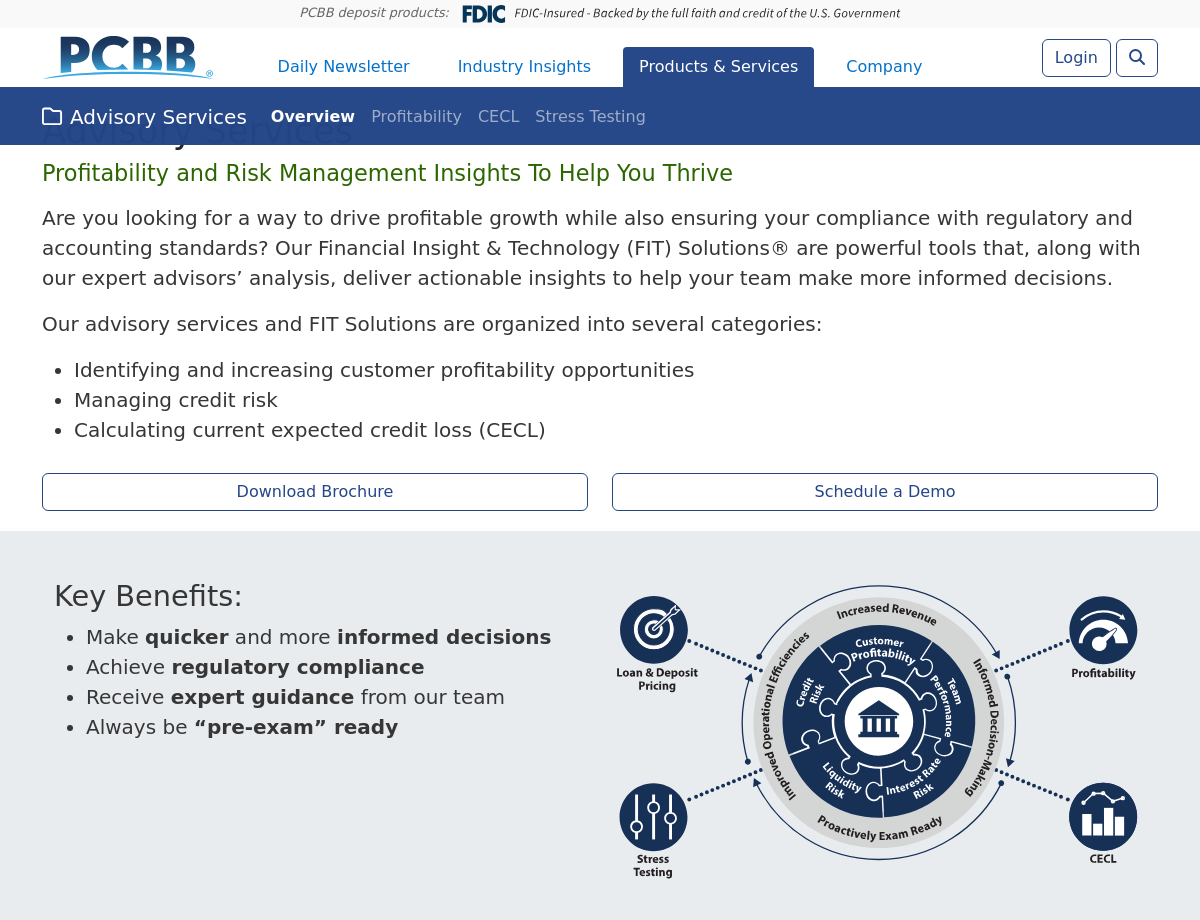

Our advisory services consist of risk management tools for customer profitability, CECL, and credit stress testing with our expert advisors guidance and expertise.

Mar 2, 2026

Meet PCBB's executive leadership team, regional managers, and product specialists.

Whitepapers

Jan 23, 2024

A guide to help you manage credit risk using four strategies. Learn about the benefits and tips of credit stress testing your loan portfolio seamlessly.

Sep 4, 2024

A survey of senior credit risk executives revealed generative AI will impact 80% of credit risk assessments within two years. We discuss how generative AI can help CFIs manage credit risk.

Jan 26, 2026

An aging population and rising demand for healthcare make this one of the fastest-growing industries and a strong fit for CFIs. We discuss opportunities and examples.

Jan 20, 2026

The financial services industry is now using agentic AI for some functions, and the list of potential use cases is growing. We discuss the most promising use cases and how CFIs might implement these agents.

Jan 14, 2026

CFIs may be more susceptible to geopolitical events than it appears. We discuss some of the hidden risks and how to plan and prepare for them, if they do impact your institution.

Dec 23, 2025

Per tradition, we're looking back on our top articles of the year to BID goodbye to 2025. This September, we talked with PCBB CEO Curt Hecker to get his take on strategic priorities for 2026 and beyond. We discussed regulatory changes, talent shortages, tailoring your goals to your institution’s size, and more.

Dec 9, 2025

CFIs are contending with CECL process pressures, vendor support gaps, and tool migration challenges amid economic and regulatory shifts. We offer practical tips.

Dec 4, 2025

As community financial institutions continue looking for new sources of fee income, hedging may be the answer —particularly in an economic environment with mixed expectations.

Nov 13, 2025

SMB cyberattacks are rising as CFIs face growing counterparty risk. How do customer-side breaches impact credit, liquidity, and reputation — and what CFIs can do now to prepare?

Oct 23, 2025

As small businesses rapidly adopt AI to stay competitive, CFIs must evolve too — integrating AI tools to meet rising expectations for speed, insight, and personalized financial guidance.

Oct 1, 2025

Financial institutions are investing heavily in cash management automation, but many fail to see results without aligning strategy and processes. We provide tips for more successful initiatives.

Sep 16, 2025

We talked with PCBB CEO Curt Hecker to get his take on strategic priorities for 2026 and beyond. We discussed regulatory changes, talent shortages, tailoring your goals to your institution’s size, and more.