First, you ask a question you want to solve, then you do some basic research to form a hypothesis, subsequently design and conduct an experiment, and lastly draw conclusions from what you observed and recorded. That’s the boiled-down version of the scientific method — something we all learn in middle school or junior high before conducting homemade experiments and putting together standing presentation boards to display at school science fairs. However, most of these experiments won’t have a big impact on the world beyond a student’s grade. The Federal Open Market Committee’s (FOMC’s) hypotheses, however, have a colossal effect on our economy. In realization of this, the FOMC takes rate cuts under careful consideration as we continue to battle our way out of above-average inflation, an abnormal yield curve, and other economic indicators that require a lot of balance to properly manage.Last week, the FOMC made the decision to lower rates from the 4.25%-4.50% range by 25bp to be 4.00%-4.25%. It wasn’t a decision taken lightly, given that every other predicted rate cut so far this year has been voted down. Chairman Powell has been noted as saying that the rate cut wasn’t for the typical reasons of feeling more secure about inflation. “You could think of this, in a way, as a risk management cut,” Powell said at the post-meeting press conference. “If you look at the SEP, actually the projections for growth this year and next actually ticked up just a little bit and inflation and unemployment didn't really move.”The Method Behind the Interest Rate MadnessThere are some curious things to note about how and why the September rate cut has happened, along with some impacts that community financial institutions (CFIs) will have to prepare for. Here are five factors influencing the rate reduction at the FOMC’s September meeting that you need to know:

- First rate cut of 2025. While the year started off with multiple rate cuts anticipated (some in the first half of the year), the FOMC continually pushed the anticipated rate cuts back to the point that some industry experts wondered if any rate cuts would take place in 2025. This rate cut had been just as up in the air as in previous months, until unexpectedly low August job numbers were released and the Fed signaled that it would cut rates to address the weakening labor market.

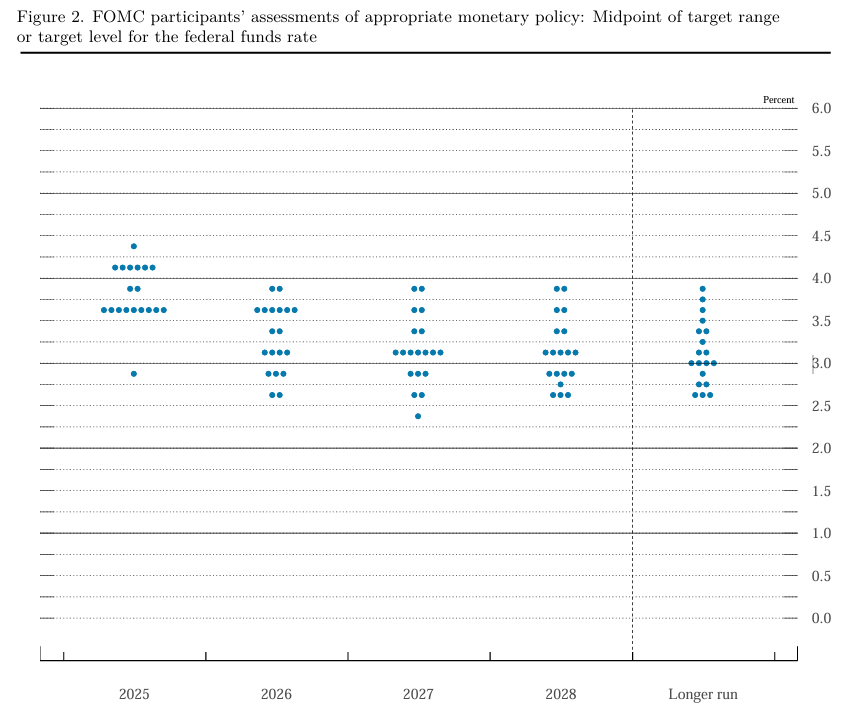

- More rate cuts expected in 2025. The dot plot noted that two additional interest rate cuts are on the table in Q4, as a risk management response to ongoing economic uncertainty. There’s also one cut projected for each 2026 and 2027, but the exact timing and amounts of each vary among FOMC members.

- Economic growth is projected to remain slow. The FOMC’s US economic growth projections increased slightly to 1.6% from 1.4% by the end of 2025, but remained 1.8% over the longer term, indicating a continued slow growth rate for the US economy.

- Labor market struggles persist. For several months now, the jobs numbers have been belatedly adjusted down from their initial reporting. Unemployment is expected to increase, as well, creating strain on the economy overall.

- Political pressure. Newly appointed Fed governor Stephen Moran is a top candidate to replace Chairman Powell when his tenure as the head of the Federal Reserve Board of Governors ends in early 2026. The change of chairman could also alter the course of future rate cuts. Moran was the only governor voting for a 50bp rate cut.

Source: Federal ReserveImpact on CFIsThere are a variety of impacts CFIs could see from the rate reduction, including the following:

- NIM compression. A lower terminal Fed funds rate will cause loan yields to price downward, putting pressure on margins between yields and deposits.

- Credit strain. With a weaker labor market persisting, unemployment could cause a modest increase in loan delinquencies and additional credit strain as consumer spending tempers.

- Increased loan demand. As an effect of the rate cuts, loan demand may go up as borrowers look for lower rates or refinance current loans that have higher rates.

How CFIs Can RespondThough the effects of the rate cut (and possible Q4 rate cuts) will vary between institutions, there are some practices that can help ease any pressure your CFI might face.

- Prepare for rates to be lower for longer.

- Extend asset duration to preserve NIM in your current portfolio.

- Hedge against interest rate risk.

- Maintain tight credit standards.

- Emphasize flexibility to address multiple rate scenarios in 2026.

The Fed’s recent rate cut signals a turning point in this year’s economic narrative, balancing concerns of a slowing labor market with hopes of stabilizing growth. While CFIs may experience challenges like margin pressure and credit strain, the shift could also open opportunities in lending. By proactively managing risk and maintaining flexibility, CFIs can navigate these uncertainties while positioning themselves for long-term resilience.