Results include

- 1 People

- 8 Webpages

- 1 Whitepapers

- 10 BID Newsletters

People

SVP & Regional Manager, Southwest Region

Michael A. Johnson brings over 30 years of experience in financial services, specializing in capital markets, balance sheet liquidity, and correspondent services. His extensive background in relations...

Webpages

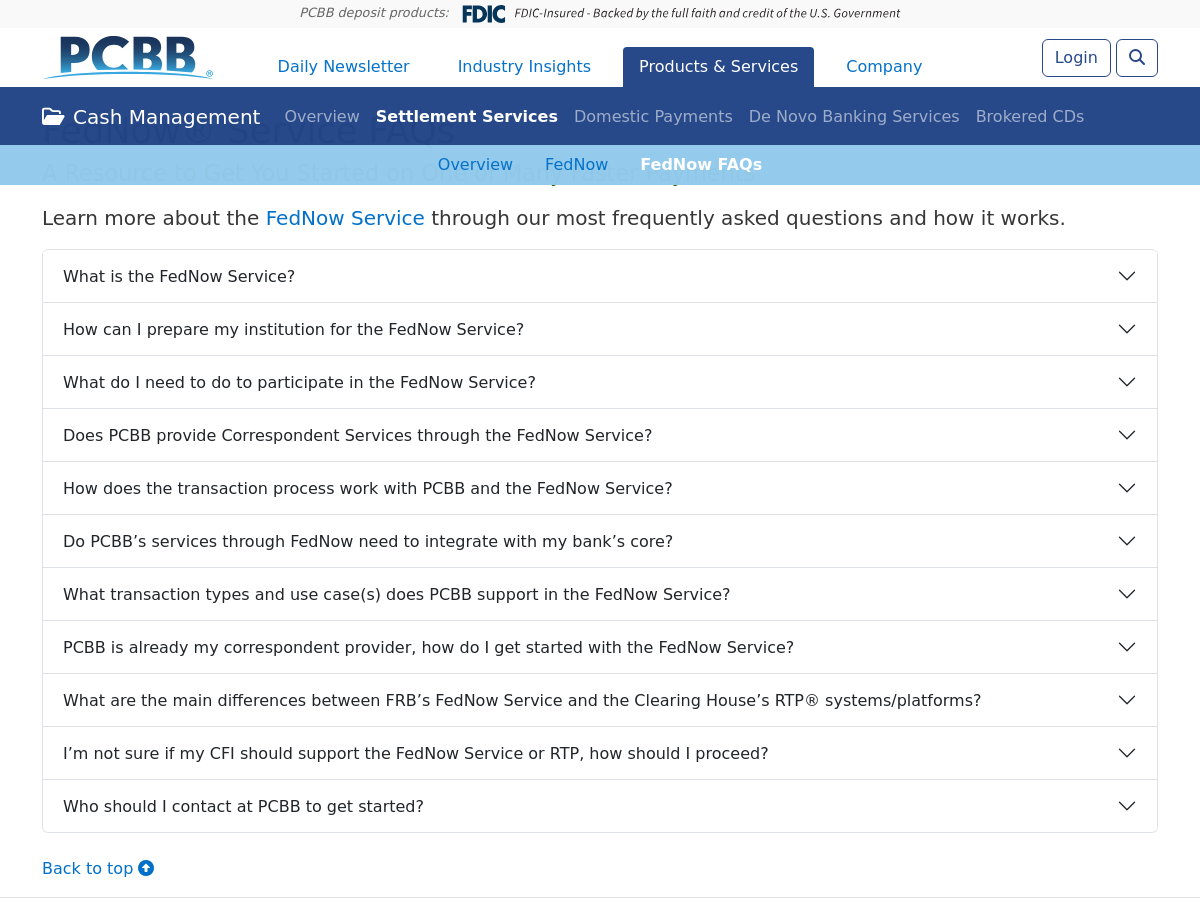

Mar 6, 2026

PCBB is certified liquidity and settlement provider for the FedNow® Service. Learn how instant payments can benefit your customer and your institution.

Mar 4, 2026

We can help you protect your core deposits through the issuance of brokered CDs. A flexible and cost-effective option to increase liquidity.

Mar 7, 2026

Streamline your banking operations to better serve your customers. Our Cash Management suite of services include settlement/clearing, De Novo Bank services, domestic payments, liquidity and settlement provider for the FedNow Service, brokered certificates

Mar 7, 2026

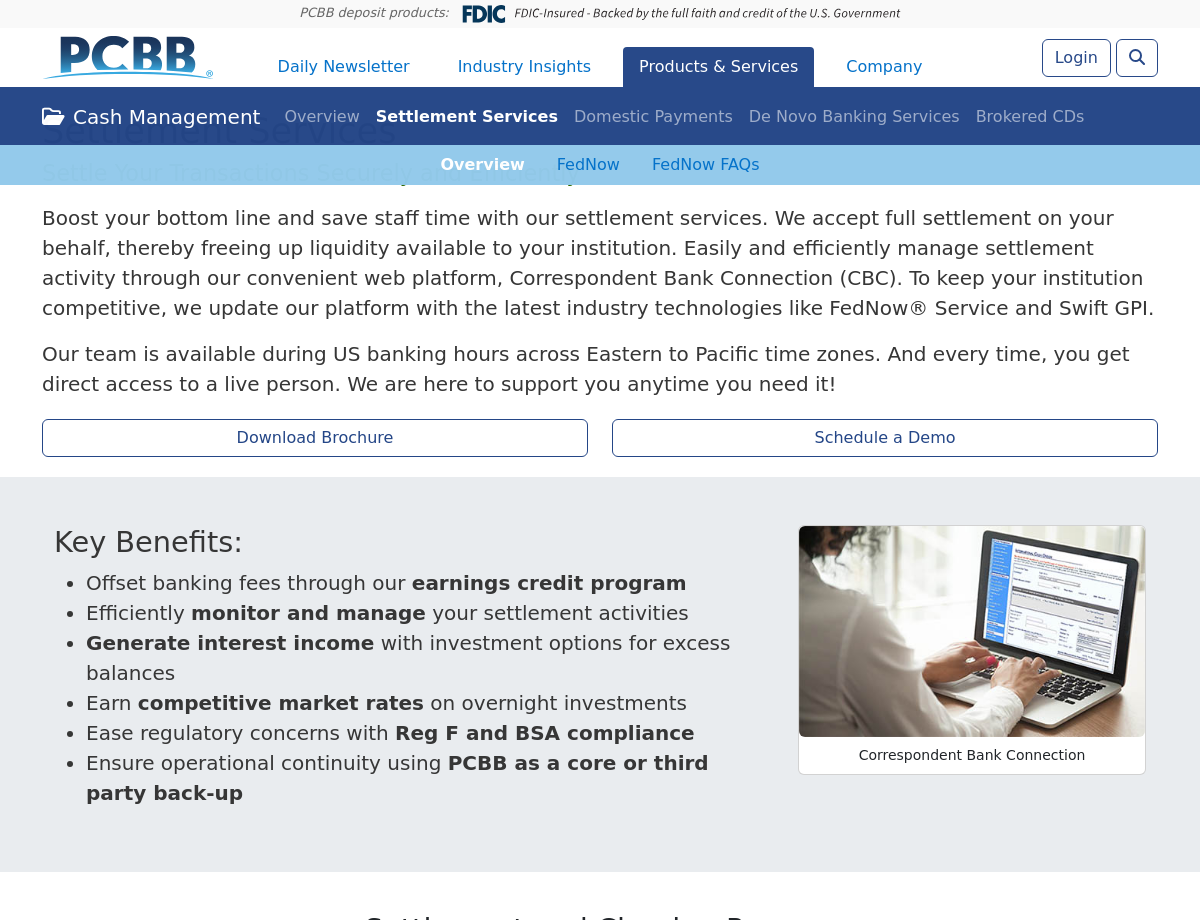

Seamlessly manage your financial transactions with PCBBs comprehensive settlement services. Discover secure, efficient solutions that will help your institution optimize your operations. PCBB is a certified liquidity and settlement FedNow Service provider

Mar 2, 2026

Learn how your institution can offer instant payments via the FedNow® Service and why PCBB is your ideal liquidity and settlement provider.

Mar 7, 2026

With PCBB's lending solutions, take on the competitive market confidently. Leverage our expert insights and tools to diversify your loan portfolio, attract and retain customers, and ensure regulatory compliance.

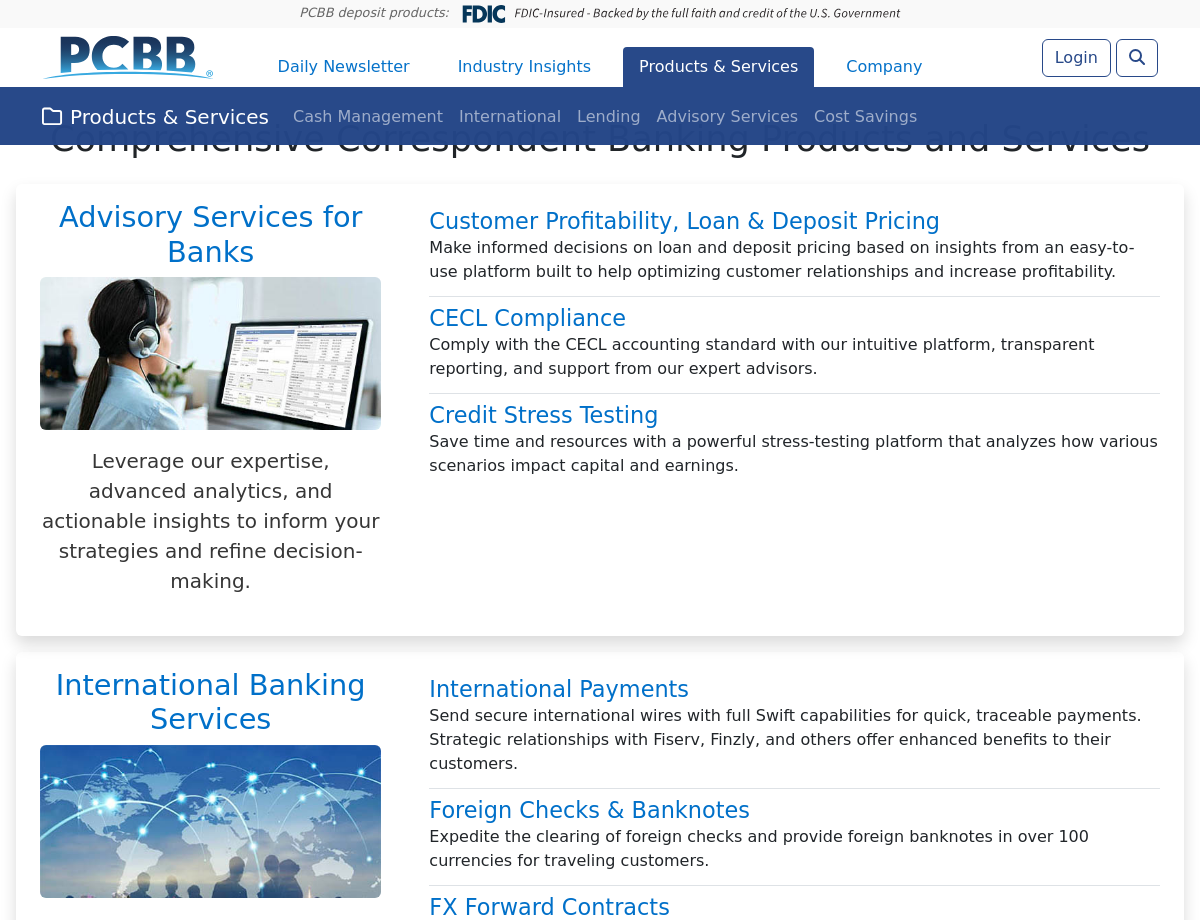

Mar 7, 2026

At PCBB, we provide a comprehensive suite of correspondent banking services designed to empower community financial institutions. With our expertise, you can enhance revenue, streamline operations, and minimize risk — all while meeting your customers&rsqu

Mar 7, 2026

Meet PCBB's executive leadership team, regional managers, and product specialists.

Whitepapers

Dec 8, 2023

With recent market downturns, interest rate fluctuations, and even liquidity issues, stress testing can allow you to identify potential risk in your portfolio and the impact on earnings, liquidity, and capital. Where do you start? Checkout this paper that offers 6 stress testing tips to see the possible risks in your portfolio and the impact on earnings, liquidity and capital.

Jul 1, 2025

With recent Fed funds market changes, CFIs should closely monitor liquidity buffers to ensure adequate cash flow volatility protection. We suggest strategies for a proactive approach.

Feb 23, 2026

Digital payments rise, but cash remains vital for CFIs. Learn how digital tools and smarter governance can modernize cash management, strengthen liquidity, and boost efficiency without major transformation.

Apr 1, 2025

With over 1K participating institutions, CFIs can use FedNow instant payments to enhance liquidity, reduce costs, and compete effectively in the evolving payments landscape.

Jan 27, 2026

Reciprocal deposits route portions of big accounts to multiple banks so each remains within FDIC limits. We cover how your institution can apply this structure to help improve liquidity metrics and depositor satisfaction.

Nov 13, 2025

SMB cyberattacks are rising as CFIs face growing counterparty risk. How do customer-side breaches impact credit, liquidity, and reputation — and what CFIs can do now to prepare?

Jun 30, 2025

CFIs still need cash on hand to satisfy the needs of their customers, particularly SMBs. Smart ATMs with embedded IoT sensors and cash recycling capabilities can help CFIs better manage their cash on hand while maintaining enough liquidity.

Dec 30, 2024

Following tradition, we're taking a look back at your favorite articles from this year as we BID adieu to 2024. In the scramble for liquidity, attracting deposits was a top priority for CFIs, and this was one of our most-read articles. Is getting into an interest-rate war the only way for CFIs to compete for deposits at higher interest rates? We review alternative strategies for keeping up with aggressive offers from online banks and other competitors.

May 1, 2024

The results are in, and according to the Bank Director’s 2024 Risk Survey, the banking industry’s top challenges center around deposit pricing, liquidity management, and regulatory requirements. We review the survey’s findings to uncover the factors driving these challenges forward.

Dec 3, 2024

Over the past year, the financial sector has witnessed many disruptive forces. In a three-part series, we review the challenges CFIs have faced and how they have responded.

Nov 6, 2024

CFIs have a unique opportunity to diversify their portfolios and manage risk by participating in shared national credits, also known as syndicated loans. Learn about the key advantages CFIs can gain.