Results include

- 4 People

- 5 Webpages

- 2 Case Studies

- 1 Podcasts

- 8 BID Newsletters

People

EVP, Chief Lending Officer

B.S. Cornell University

MBA Crummer School of Business, Rollins College

Mr. Hines is currently Executive Vice President of the Bank of Glen Burnie (NASDAQ GLBZ) and has served as the Chief Lending...

Senior Vice President

Carrie Foster has over 25 years of experience in accounting and auditing, with a concentration in financial institutions. In her current role at PCBB, Carrie specializes in implementation, strategy, a...

SVP & Regional Manager, MidAtlantic Region

Dennis Falk has over 43 years of banking and capital markets experience. In his current role at PCBB, he manages client relationships with community banks throughout Washington, Delaware, Maryland, th...

SVP & Regional Manager, Southwest Region

Michael A. Johnson brings over 30 years of experience in financial services, specializing in capital markets, balance sheet liquidity, and correspondent services. His extensive background in relations...

Webpages

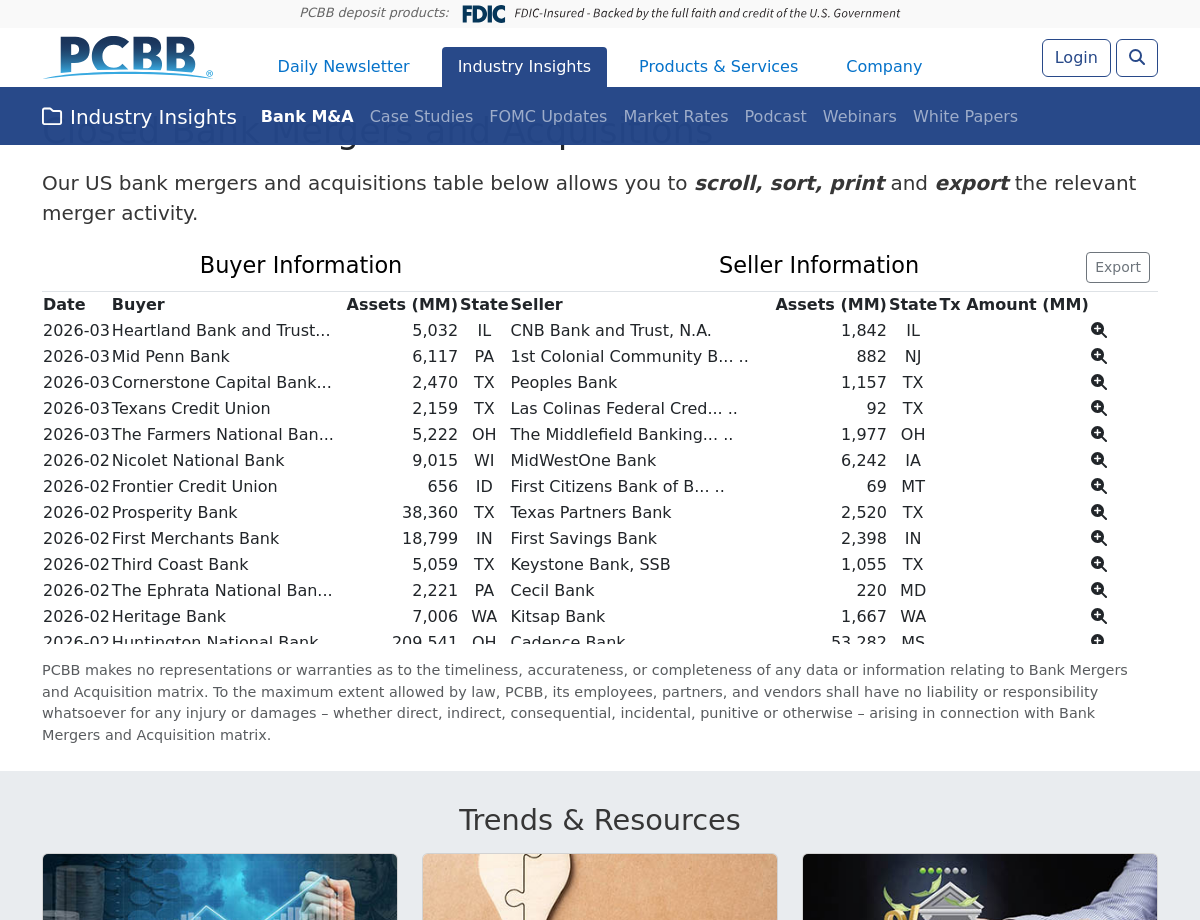

Mar 5, 2026

The latest information concerning bank mergers and acquisitions.

Mar 5, 2026

Keep up with industry updates and market trends through our whitepapers, podcasts, webinars, and more for cutting-edge industry insights tailored for community financial institutions. Access bank mergers and acquisitions, economic forecasts, and daily mar

Mar 4, 2026

On-demand webinars covering a range of banking industry topics such as international payment, CECL, loan hedging, C&I, and customer profitability.

Mar 4, 2026

Read the latest banking news, trends, facts, and opinions focused on issues vital to community financial institutions.

Mar 4, 2026

Stress test your loan portfolio and evaluate the resulting impact on both earnings and capital.

Case Studies

Feb 7, 2026

How one community bank strengthened its international wire offering, improved efficiency, and delivered a better client experience with PCBB.

Jul 1, 2018

How PCBB helped a rural community bank compete with the big banks and win by helping them offer their customers long term fixed rates while getting a floating-rate asset on the books.

Podcasts

Feb 25, 2026

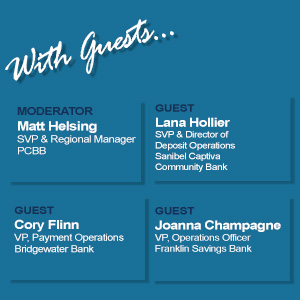

In this episode of Banking Out Loud, PCBB’s Matt Helsing talks with three community bankers about modernizing the way they clear Canadian checks. By leveraging PCBB’s Canadian Check Image solution through the Fiserv Clearing Network, they’ve streamlined operations while reducing costs associated with overnight shipments and exchange rates.

Nov 26, 2025

According to the Bank Director’s 2026 Bank M&A Survey, the CFI M&A landscape is shifting. Deal activity is still subdued, but interest in community bank acquisitions is rising.

Feb 24, 2026

Automation helps even small CFIs reduce manual workload, improve accuracy, and boost service quality. Starting small and scaling smart can enhance efficiency, strengthen compliance, and empower employees to focus on higher-value work.

Feb 17, 2026

Deposit growth is rebounding in 2026, driven by Gen Z and Millennials. Discover how CFIs can attract young depositors with personalization, digital tools, and incentives that build long-term loyalty.

Feb 11, 2026

A newly introduced bill aims to reduce regulatory burden and improve funding flexibility for community banks. We break down the key provisions and what they could mean for supervision, capital, and growth.

Jan 28, 2026

The OCC has issued streamlined BSA/AML examination guidelines for CFIs that are at lower risk for money laundering and terrorist financing activities. We detail what the changes are for CFIs that qualify.

Jan 27, 2026

Reciprocal deposits route portions of big accounts to multiple banks so each remains within FDIC limits. We cover how your institution can apply this structure to help improve liquidity metrics and depositor satisfaction.

Jan 26, 2026

An aging population and rising demand for healthcare make this one of the fastest-growing industries and a strong fit for CFIs. We discuss opportunities and examples.

Jan 12, 2026

Some CFIs have created advisory boards of community members who can help their CFI keep a pulse on the needs of local businesses. We delve further into the concept.