Results include

- 1 People

- 10 Webpages

- 1 Whitepapers

- 8 BID Newsletters

People

SVP & Regional Manager, Southwest Region

Michael A. Johnson brings over 30 years of experience in financial services, specializing in capital markets, balance sheet liquidity, and correspondent services. His extensive background in relations...

Webpages

Dec 28, 2025

PCBB is certified liquidity and settlement provider for the FedNow® Service. Learn how instant payments can benefit your customer and your institution.

Dec 15, 2025

We can help you protect your core deposits through the issuance of brokered CDs. A flexible and cost-effective option to increase liquidity.

Dec 28, 2025

Streamline your banking operations to better serve your customers. Our Cash Management suite of services include settlement/clearing, De Novo Bank services, domestic payments, liquidity and settlement provider for the FedNow Service, brokered certificates

Dec 28, 2025

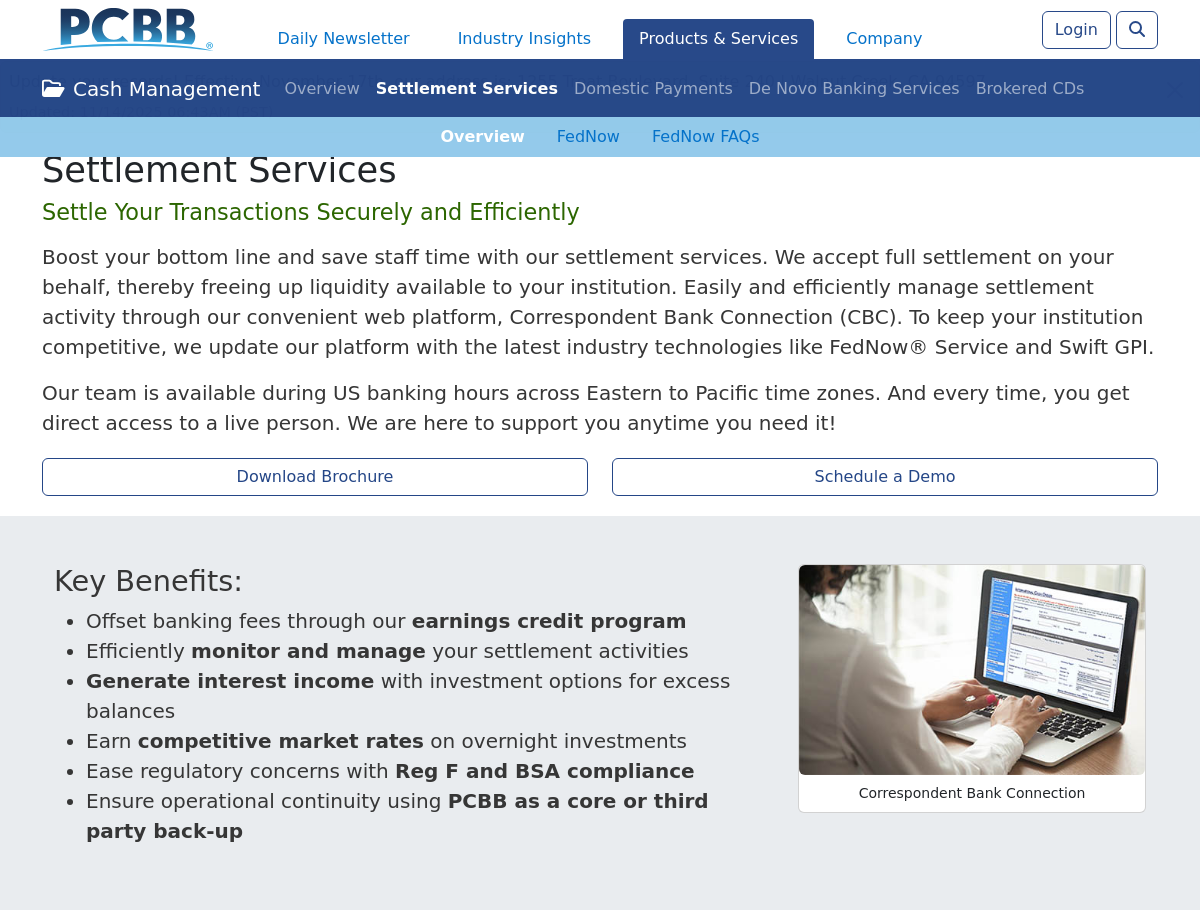

Seamlessly manage your financial transactions with PCBBs comprehensive settlement services. Discover secure, efficient solutions that will help your institution optimize your operations. PCBB is a certified liquidity and settlement FedNow Service provider

Dec 27, 2025

Learn how your institution can offer instant payments via the FedNow® Service and why PCBB is your ideal liquidity and settlement provider.

Dec 28, 2025

Provide long-term, fixed-rates to your customers, while your institution receives a floating rate through our loan hedging solution, Borrowers Loan Protection (BLP).

Dec 28, 2025

With PCBB's lending solutions, take on the competitive market confidently. Leverage our expert insights and tools to diversify your loan portfolio, attract and retain customers, and ensure regulatory compliance.

Dec 28, 2025

At PCBB, we provide a comprehensive suite of correspondent banking services designed to empower community financial institutions. With our expertise, you can enhance revenue, streamline operations, and minimize risk — all while meeting your customers&rsqu

Dec 27, 2025

Meet your loan growth objectives, diversify your portfolio, and earn floating rate interest income with our C&I Loans.

Dec 27, 2025

Learn about the benefits of ISO 20022, implementation, and what does it mean for PCBBs early adoption. We address most trending questions surrounding ISO 20022.

Whitepapers

Dec 8, 2023

With recent market downturns, interest rate fluctuations, and even liquidity issues, stress testing can allow you to identify potential risk in your portfolio and the impact on earnings, liquidity, and capital. Where do you start? Checkout this paper that offers 6 stress testing tips to see the possible risks in your portfolio and the impact on earnings, liquidity and capital.

Jul 1, 2025

With recent Fed funds market changes, CFIs should closely monitor liquidity buffers to ensure adequate cash flow volatility protection. We suggest strategies for a proactive approach.

Apr 1, 2025

With over 1K participating institutions, CFIs can use FedNow instant payments to enhance liquidity, reduce costs, and compete effectively in the evolving payments landscape.

Nov 13, 2025

SMB cyberattacks are rising as CFIs face growing counterparty risk. How do customer-side breaches impact credit, liquidity, and reputation — and what CFIs can do now to prepare?

Jun 30, 2025

CFIs still need cash on hand to satisfy the needs of their customers, particularly SMBs. Smart ATMs with embedded IoT sensors and cash recycling capabilities can help CFIs better manage their cash on hand while maintaining enough liquidity.

Dec 30, 2024

Following tradition, we're taking a look back at your favorite articles from this year as we BID adieu to 2024. In the scramble for liquidity, attracting deposits was a top priority for CFIs, and this was one of our most-read articles. Is getting into an interest-rate war the only way for CFIs to compete for deposits at higher interest rates? We review alternative strategies for keeping up with aggressive offers from online banks and other competitors.

May 1, 2024

The results are in, and according to the Bank Director’s 2024 Risk Survey, the banking industry’s top challenges center around deposit pricing, liquidity management, and regulatory requirements. We review the survey’s findings to uncover the factors driving these challenges forward.

Dec 3, 2024

Over the past year, the financial sector has witnessed many disruptive forces. In a three-part series, we review the challenges CFIs have faced and how they have responded.

Nov 6, 2024

CFIs have a unique opportunity to diversify their portfolios and manage risk by participating in shared national credits, also known as syndicated loans. Learn about the key advantages CFIs can gain.