Results include

- 1 People

- 8 Webpages

- 11 BID Newsletters

People

SVP & Chief Risk Officer

Radhika brings over 30 years of risk management, compliance, and internal audit experience at prestigious global companies, financial institutions, and fintech startups. As Chief Risk Officer, Radhika...

Webpages

Feb 13, 2026

Maximize savings and improve your services through our core vendor evaluation service. Strengthen your relationship with both your vendor and your customer.

Feb 10, 2026

Discover savings on your banking operational costs through vendor contract evaluations.

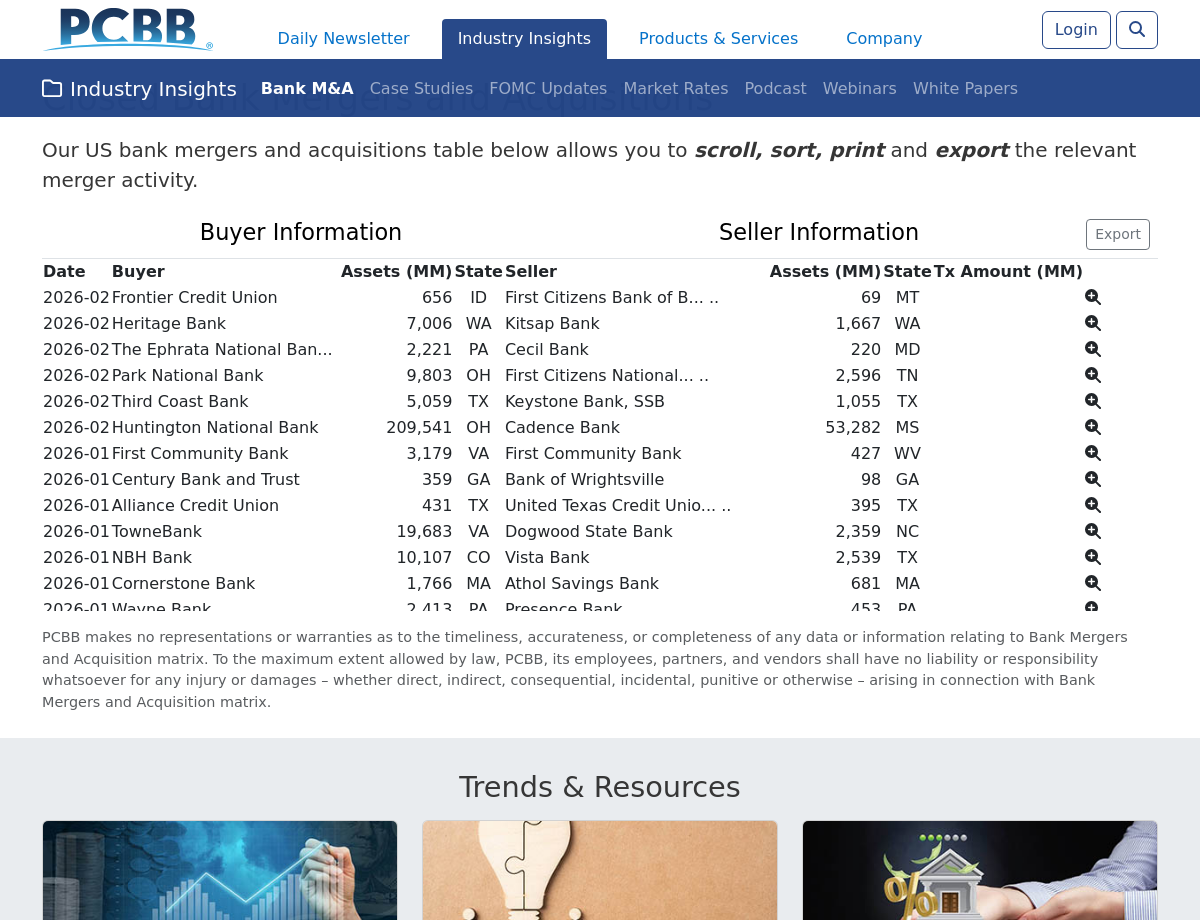

Feb 13, 2026

The latest information concerning bank mergers and acquisitions.

Feb 13, 2026

At PCBB, we provide a comprehensive suite of correspondent banking services designed to empower community financial institutions. With our expertise, you can enhance revenue, streamline operations, and minimize risk — all while meeting your customers&rsqu

Feb 12, 2026

PCBB milestones and accomplishments from over 25 years as an innovative leader in the banking industry.

Feb 10, 2026

If your check printing contract expires within 2 years, you will save a substantial amount through our partners contract evaluation/negotiation service.

Feb 3, 2026

Help your business customers with international businesses save by locking in foreign exchange rates for a future date through FX Forward Contracts. All while your institution generates fee income

Dec 9, 2025

CFIs are contending with CECL process pressures, vendor support gaps, and tool migration challenges amid economic and regulatory shifts. We offer practical tips.

Jul 8, 2025

CFIs have connections with lots of service providers likes lawyers and accountants. By leveraging that base of expertise, CFIs can connect SMB and commercial customers to the services they need.

Jun 9, 2025

In the current economic climate, CFIs are prioritizing efficiency. One area to consider is the vendor management program, specifically looking at standardizing processes, integrating systems, and automating workflows.

Jan 23, 2025

A recent survey of financial institution executives revealed due diligence and oversight for third-party vendor cybersecurity is inadequate. We highlight key findings and provide strategies to strengthen vendor cybersecurity.

Jun 11, 2024

A spate of regulatory actions against banks for compliance deficiencies in their fintech partnerships has bankers concerned. We discuss recent consent orders and provide tips on managing third-party vendor risk.

Apr 23, 2024

For small business customers, waiting for payments can take a while — often at least 30 days. Checks and invoices get lost or go to spam folders and vendors charge fees to transfer funds. Doing more to remove these pain points can help strengthen existing relationships and allow your small business clients to have better cash management. We discuss ways to help small business customers get paid quickly and easily.

Feb 3, 2026

After years of rapid growth, many neobanks are facing the same pressures traditional institutions have long managed: profitability, risk, and retention. Here’s what CFIs can learn from what’s working — and what’s not — in the digital banking space.

Feb 2, 2026

Cyber attacks cause expensive damage. While cyber insurance can help mitigate the cost, it’s not as foolproof as you hope. We discuss risks and preparedness in finalizing your cyber insurance policy.

Jan 29, 2026

We sat down with PCBB President Mike Dohren to talk about what 2026 might have in store for CFIs, from M&A trends to regulatory expectations and the biggest threats CFIs could face this year.

Jan 20, 2026

The financial services industry is now using agentic AI for some functions, and the list of potential use cases is growing. We discuss the most promising use cases and how CFIs might implement these agents.

Jan 6, 2026

As tech and strategy become synonymous in banking, it’s more important than ever for stakeholders on both sides of the coin to be in step with each other. We provide tips.