Why are heist movies so popular? It could be that viewers love to see how people can figure out how to circumvent very complicated barriers to their proverbial pot of gold, often with state-of-the-art tech. Meticulously thought-out plans, contingencies for anything that could go awry — though with just enough twists to keep up the suspense. Hollywood makes it easy to cheer for the thief who beats the system — at least on screen. But in banking, similar stories unfold for far less glamorous reasons, and the consequences are real.What is first-party fraud, and why is it concerning?The same frame of mind that drives the protagonists in heist films can also apply to a different type of financial crime: first-party fraud. This brand of fraud occurs when customers themselves intentionally deceive their financial institution for monetary gain.First-party fraud is now the leading type of fraud across the world. One-third (36%) of all reported fraud in 2024, up from 15% the year before, according to LexisNexis Risk Solutions. This year, Datos Insights expects losses from first-party fraud to reach $3.9B before climbing to $4.8B by 2028. "First-party fraud has always been around and in the last couple of years, I'm hearing bankers talk a lot more about frustration over the fact that their own customers are committing fraud, which makes it a lot more difficult to find and to mitigate," Datos Insights’ Jim Mortensen says. "You always concern yourself with third-party fraudsters who were attacking both you and your customer, and now you've got your customer attacking you." Essentially, the rise of first-party fraud erodes trust between a customer and their financial institution.What are the types of first-party fraud?

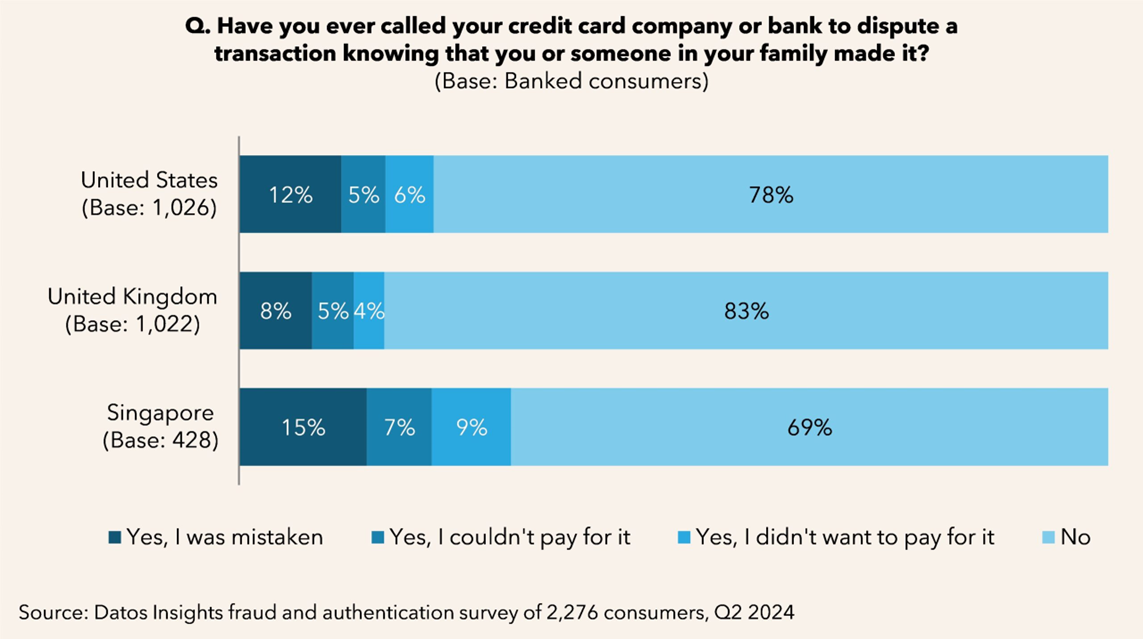

- Transactional fraud. Such fraud occurs when a customer disputes a purchase on their credit or debit card that they actually made. They might also allege that goods from an online purchase were never delivered, hoping for a chargeback to their account. Annual losses from such fraud are roughly $50B, according to Mastercard.

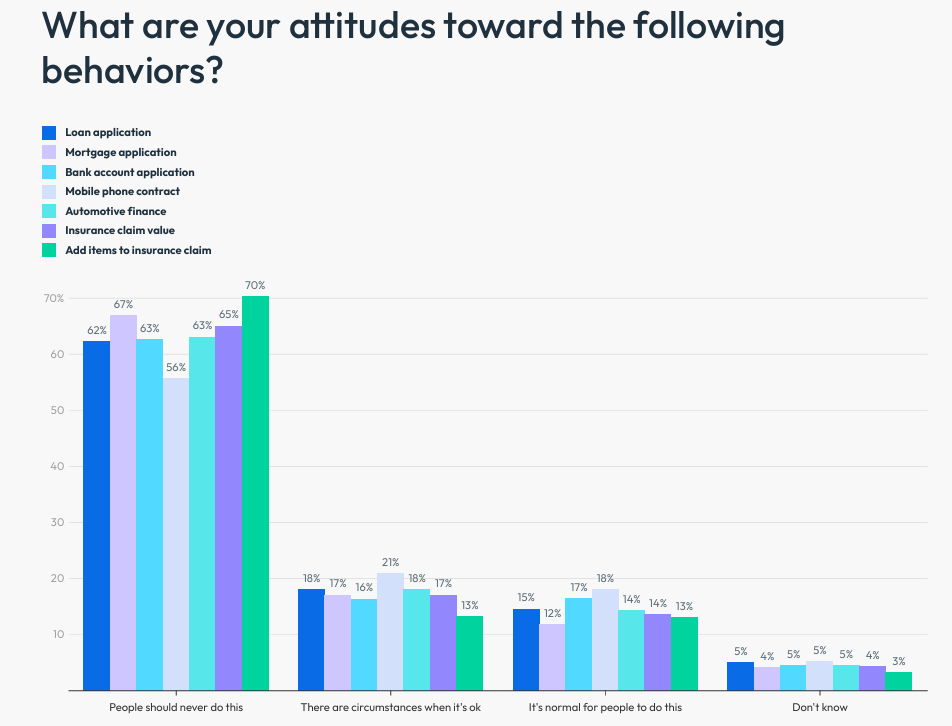

- Account-level fraud. This happens when a person deliberately lies on a credit application so they can obtain a loan that they cannot repay or never had any intention of repaying. According to a FICO survey of 1K Americans, one-third say that exaggerating their income on loan applications is either acceptable in some circumstances or normal behavior. Some likely feel like lying is the only way to obtain credit when they’re hurting financially, but it often backfires on them when they default or are cited for fraud, FICO says.

Source: FICO 2025 Consumer Survey on Fraud, Identity, and Digital BankingWhy do customers commit first-party fraud?It can be hard to understand the reasoning for a customer lying about their finances, but digging deeper reveals that the issue can fall into a gray area just as often as not. For one, it’s fairly easy and often consequence-free, tempting even those who might otherwise be “upright citizens," according to Craig Tully, a partner at Integra Advisers. “The overwhelming majority of people are not investigated,” Tully says. “There are no prosecutions. Some people may get penalties and a slap on the wrist, but that's it." People who commit first-party fraud run the gamut of reasons why, ranging from greed to need, but always rationalize their behavior. "People may say to themselves, 'I'm underpaid, so I deserve more money’ or, 'they're overpaid, so I deserve to get as much as they do,’” he says.

Source: Datos Insights

How can CFIs thwart first-party fraud?Thankfully, there are some tried-and-true resources CFIs can turn to in order to help themselves and each other reduce first-party fraud. Here are some popular options:

- Leverage technology. Software is available from multiple vendors that use machine learning to validate customer identity and detect red flags in customer behavior or account activity. One vendor, Socure, is backed by a first-party fraud consortium so that it can access data across multiple FIs. The software will place a high-risk score on someone who has opened accounts at multiple banks, returned numerous ACH transactions, disputed debit card transactions, or has a number of closed accounts due to suspected misuse. Socure won’t recommend that FIs deny that person credit, but the consortium will encourage FIs to obtain additional verification before making any decisions about the customer.

- Share information. Join networks of other FIs to discuss the latest trends and raise awareness of entities that have allegedly attempted first-party fraud.

In Hollywood, the credits roll after the heist. In banking, the story continues — and the stakes are far higher. With first-party fraud on the rise, CFIs can counter it not with movie-style drama, but with real-world collaboration, technology, and awareness. After all, even the best script can’t replace sound judgment and a united front.